Tuesday, November 23, 2010

A Proposal to Restore Reporting and Accountability Requirements for the Fed

Here is some press reaction to the proposal

Bloomberg News: “Taylor Proposes Altering Fed Law to Require 'Systematic' Rate Setting Rule”

Dow-Jones: "Stanford’s Taylor Urges Turning Monetary Policy Rules Into Law to Limit Fed”

Reuters: “Economist Taylor Wants New Law for Fed Policy"

Globe and Mail: “A Rules Based Fed?”

Another reaction, not covered in these articles, came from some of the people who had experience at the Fed in the 1980s and 1990s. They say that they found the old reporting and accountability requirements to be of value in creating a process at the Fed for discussing a monetary strategy and that the new requirements could be of similar benefit.

Sunday, November 21, 2010

The End of the Recrudescence of Keynesian Economics

Ned spoke about what he called the “recrudescence of Keynesian economics.” He explained why, as he put it in his New York Times column of last August, “The steps being taken by government officials to help the economy are based on a faulty premise. The diagnosis is that the economy is ‘constrained’ by a deficiency of aggregate demand. The officials’ prescription is to stimulate that demand, for as long as it takes, to facilitate the recovery of an otherwise undamaged economy — as if the task were to help an uninjured skater get up after a bad fall. The prescription will fail because the diagnosis is wrong.”

The problem with these Keynesian policies is that at best they give short term boosts to the economy, but then fizzle out as we are seeing now. Sustaining growth in employment requires sustaining investment, which requires government policy that encourages investment and innovation, not short-run stimulus packages that try to boost consumption and government purchases, which crowd out investment.

.

Will there be an end of this recrudescence? Politics as well as economics will be an important determining factor, at least that’s what the historical analysis in the paper I presented at the conference shows. The good news then is that more people are beginning to see the problems with these stimulus packages and the political process is responding.

Note, however, that Russ Roberts has an alternative and quite plausible "political economy" explanation for why policymakers tend to choose interventionist policies such as discretonary Keynesian stimulus packages.

Friday, November 19, 2010

The 2010 Little Big Game in Economics

Once a year, in November, the graduate students in the Stanford and Berkeley Economics Departments get together for the Little Big Game, a series of contests in basketball, volleyball, Frisbee, touch football, and soccer. The Little Big Game takes place in the days before the Big Game between the Stanford-Cal varsity football teams. This year the Little Big Game was held at Berkeley, where the Big Game between 6th ranked Stanford and unranked Berkeley will take place tomorrow.

Once a year, in November, the graduate students in the Stanford and Berkeley Economics Departments get together for the Little Big Game, a series of contests in basketball, volleyball, Frisbee, touch football, and soccer. The Little Big Game takes place in the days before the Big Game between the Stanford-Cal varsity football teams. This year the Little Big Game was held at Berkeley, where the Big Game between 6th ranked Stanford and unranked Berkeley will take place tomorrow.I am happy to report that the Little Big Game was great this year for the Stanford team, which racked up 3-1-1 won-loss-tie record, much better than last year’s 2-3 record. Stanford won in basketball, volleyball, and Frisbee, lost in football, and tied in soccer.

Stephen Terry, a second year Stanford Ph.D. student, explained the victory in the post-game wrap up, saying “I give the first year students’ credit for this one, especially Isaac Opper who led Stanford in almost all of the games. But of course we shouldn't forget our t-shirts. We rule!”

In case you’re wondering, I've included a picture of the front and back of the Stanford economics team’s t-shirt uniform for this year’s Little Big Game.

Monday, November 15, 2010

The QE2 Letter

Jackson Hole, August 29 "the benefits in terms of lower rates are very small, while the short-term costs of greater uncertainty about the exit strategy and long-term costs from a loss of independence are large."

The Taylor Rule Does Not Say Minus Six Percent, September 1

it says .75 percent which provides no rationale for QE2

More on Massive Quantitative Easing, September 8 which refers to a WSJ oped and many other critiques

Announcement Effects Do Not Prove QE Works, October 7 so the evidence cited in favor of QE2 is pretty weak

A New Normal for Monetary Policy? October 27 reflects my concerns that there would be a QE3 and a QE4. Maybe the letter and other objections will reduce the chances of this.

Milton Friedman Would Certainly Not Have Supported QE2, November 3 so be careful about citing him as support

Empirical Concerns about Anticipation Effects of QE2, November 5 which disagreed with the Washington Post article by Ben Bernanke defending QE2

QE2 and G20, November 14 in which an unintended consequence of QE2 is discussed

I have also done many TV interviews, from this interview with Steve Liesman on October 15 at the Boston Fed before QE2 was announced to this one last week on Squawk Box. To hear both sides of the issue discussed togehter, view this Newshour program with Alan Blinder and me which was also aired on October 15, or listen to this NPR program On Point with Jeremy Siegel and me. An earlier QE2 debate took place on Squawk Box on October 8 in which Jim Bullard President of the Federal Reserve Bank of St. Louis and Larry Meyer also appeared.

Sunday, November 14, 2010

QE2 and G20

The administration’s main defense is that a growing U.S. economy is good for the world. While a strong U.S. economy is certainly good for the world, it is not so clear that QE2 will help the U.S. economy grow more strongly. I have argued that QE1 did not have much positive stimulus effect and the same is likely to be true for QE2 as I explained for example in this recent interview. Moreover, if the Fed thinks that quantitative easing helps by depreciation of the dollar, that policy certainly does not help demand in other countries.

But the insertion of QE2 into the negotiations was not the reason that the United States came away with so little at the G20 meeting in South Korea. The same thing happened at the previous Q20 meeting in Canada and there was no QE2 then. As I wrote at the time of the Canadian finance ministers and central bank governors meeting, the problem with the U.S. position then and now is that the idea that more deficit spending stimulus is needed to increase demand is an idea that other countries strongly disagree with, and in my view they are right. Indeed, the G20 has been getting on the right track despite the U.S. postion. The United States was able to sell stimulus packages to the G20 in early 2009, but most see that it has not done much good and has made the debt higher. The way to have a more successful G20 meeting in France next year is for the United States to go with a credible plan to reduce the budget and stop increasing the debt.

Friday, November 5, 2010

Empirical Questions About the Anticipation Effects of QE2

“Stock prices rose and long-term interest rates fell when investors began to anticipate the most recent action.”

How can one determine whether stock prices rose and long-term interest rates fell in anticipation of QE2? Obviously it is very difficult because many other things affect stock and bond markets, and one can never know for sure, but the data presented in the following charts raise serious doubts that such anticipation effects were either substantial or sustainable.

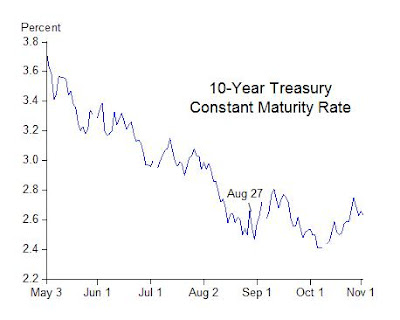

First consider long-term Treasury interest rates. The first chart shows the interest rate on benchmark 10-year Treasury bonds. Note that these long-term interest rates had been coming down since May—long before markets could reasonably have anticipated another large dose of quantitative easing. They have been relatively flat since August. But to assess more formally whether long-term interest rates fell “when investors began to anticipate” QE2, one must consider a date or dates on when such anticipations are likely to have begun.

One logical date is August 27, the day of Ben Bernanke’s Jackson Hole speech where he discussed the framework of quantitative easing in detail. Indeed, this Jackson Hole speech is frequently mentioned in the financial press. The date of the speech is shown in the chart. The long-term rate was 2.66 percent on that date. If anticipations of quantitative easing lowered long-term interest rates, then one would expect this rate to have been lower on November 2, the day before the FOMC’s recent action. But this is not what happened. The interest rate was the same 2.66 percent on November 2 as it was on August 27.

What about other long-term interest rates? The second chart shows the interest rates on Moody’s Aaa and Baa corporate bonds. On November 2 the Moody’s Baa corporate rate was 5.71 percent compared with 5.62 percent on August 27. And on November 2 the Aaa rate was 4.66 percent compared with 4.41 percent on August 27. In both cases rates were higher, rather than lower, compared with what rates were on the day investors could plausibly have begun to anticipate the recent action. Next consider stock prices. The third chart shows the S&P 500 index over the same period. Observe that the current rally began in early July as shown in the chart. Evidently concerns about a double dip recession had diminished by early July and earnings reports began improving. From July 2 to August 10 the S&P 500 rallied by 10 percent. That rally was temporarily interrupted starting on August 10, but then continued. From August 10 to November 2 the S&P 500 rose another 7 percent.

Next consider stock prices. The third chart shows the S&P 500 index over the same period. Observe that the current rally began in early July as shown in the chart. Evidently concerns about a double dip recession had diminished by early July and earnings reports began improving. From July 2 to August 10 the S&P 500 rallied by 10 percent. That rally was temporarily interrupted starting on August 10, but then continued. From August 10 to November 2 the S&P 500 rose another 7 percent.

Any assessment of the impact of anticipations of QE2 on stock prices depends crucially on how one interprets this rally and the interruption around August 10. It is important to note that August 10 was the day of the FOMC meeting where the Fed first indicated it would reinvest the maturing mortgage backed securities into the Treasury market, so this first hint of quantitative easing had a negative impact on stock prices. This was also the meeting where the Fed appeared to be very downbeat about the economy and revealed considerable dissention among FOMC members about how policy decisions would be made going forward. Jon Hilsenrath later wrote about this meeting in detail in the Wall Street Journal calling it "among the most contentious in Ben Bernanke's four and a half year tenure as central bank chairman." Hence, the large negative impact on stock prices is understandable.

Ben Bernanke’s August 27 Jackson Hole speech was helpful in this regard because it undid the damage of the August 10 meeting, as I argued at the time, by presenting a transparent framework for making decisions and conveying the image of a more functional FOMC than portrayed, for example, in Hilsenrath’s article. So in my view, the consistent story is that the August stock market dip was Fed-induced and its reversal was also Fed-induced. In contrast an explanation based on anticipations of quantitative easing is inconsistent because stock prices went one way on August 10 and another way on August 27.

In any case these interest rate and stock price data raise doubts about the narrative that long-term interest rates fell and stock prices rose in anticipation of QE2. As with all the other stimulus programs tried in recent years, it is important to get the narrative right, and more empirical work is welcome.

Wednesday, November 3, 2010

Certainly Milton Friedman Would Not Have Supported QE2

One issue which is not addressed by these pieces is the argument that the rise in the stock market since late August, when Ben Bernanke started the march toward QE2 at Jackson Hole, is evidence in support. I view the stock market behavior differently. The recent rally began in July, but was interrupted by the highly argumentative and downbeat FOMC meeting on August 10, which Bernanke clarified in Jackson Hole on August 27, and then the rally continued, bolstered by good earnings reports and strong growth abroad, not, in my view, by anticipations of quantitative easing.

But at times like these we need a little humor. This cartoon is from the collection of Hank Blaustein posted on Jim Grant's Interest Rate Observer web page, where you can purchase this and other cartoons in a 4" x 4" reproduction, signed by the artist.