France: Business Activity Continues Contraction at Marked Pace

Key points:Italy: Services Activity Continues Contraction at Sharp Rate in May

- Final Markit France Services Activity Index at 45.1 (45.2 in April), 7-month low.

- Final Markit France Composite Output Index at 44.6 (45.9 in April), 37-month low.

Summary:French service providers registered another sharp decrease in business activity during May. Underlying the weak performance was a second successive fall in incoming new business, while backlogs of work fell further. Companies responded by cutting employment. Input price inflation eased to the slowest for over two years, allowing companies to reduce their charges further.

Key Points:Spain: Activity and new business both decline at faster rates

- Business activity and new work both decrease markedly

- Employment falls at slowest rate for seven months

- Cost inflation weakest since last November

Summary:

The health of the Italian service sector deteriorated during May, with steep falls in both output and new business recorded. Confidence with regards to activity in the forthcoming year dipped further, though employment levels fell at a slower rate. Cost inflation meanwhile eased to the weakest in six months, but still contrasted with a sustained drop in output prices.

Key points:Germany: German Composite Output Index in Contraction

- Activity and new business both decline at faster rates

- Job shedding intensifies

- Sharp cuts in output prices as cost inflation eases

Summary:

The Spanish service sector fell further into contractionary territory during May as the economic crisis showed no signs of easing. Rates of decline in activity, new orders and employment all accelerated during the month. Meanwhile, input prices rose only slightly as companies attempted to reduce costs, and output prices were cut sharply again in response to strong competition and weak demand.

Key points:Eurozone: Composite PMI near-three year low in May

- Final Germany Services Business Activity Index(1) at 51.8 in May, down from 52.2 in April.

- Final Germany Composite Output Index(2) at 49.3 in May, down from 50.5 in April.

Summary:

May data pointed to a renewed slowdown in German service sector growth, as falling levels of incoming new work continued to weigh on business activity levels. At 51.8, down from 52.2 in April, the final seasonally adjusted Germany Services Business Activity Index pointed to the slowest pace of expansion since November 2011. Higher levels of output have now been recorded for eight months running, but the pace of expansion in May was below the average seen since the survey began 15 years ago (53.0).

Key Points:If the ECB is looking for an excuse to cut rates, it sure has one.

- Final Eurozone Composite Output Index: 46.0 (Flash 45.9, April 46.7)

- Final Eurozone Services Business Activity Index: 46.7 (Flash 46.5, April 46.9)

- Widespread weakness across the currency union, with output falling across the big-four nations

Summary:

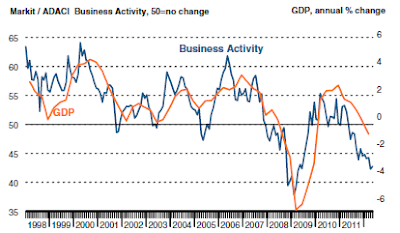

At 46.0 in May, down from 46.7 in April, the Markit Eurozone PMI® Composite Output Index signalled the steepest rate of decline in manufacturing and services output in the single currency area since June 2009. The headline index came in slightly above its flash estimate of 45.9, but remained below the neutral 50.0 mark for the fourth month running.

Comment:

Chris Williamson, Chief Economist at Markit said: "The final Eurozone PMI edged up on the flash reading in May, but nevertheless indicates that the economy is contracting at the fastest pace for around three years. Companies report business activity to have been hit by heightened political and economic uncertainty, which has exacerbated already weak demand both in the euro area and further afield. Based on these numbers, it would not be surprising to see GDP for the region contract by 0.5% in the second quarter, though an even steeper decline could be seen if the June data disappoint."

Mike "Mish" Shedlock

http://globaleconomicanalysis.blogspot.com

Click Here To Scroll Thru My Recent Post List

No comments:

Post a Comment